All you need to know

as a beginner about

stock markets, investments,

trading & more..

Hedging is similar to purchasing insurance against any negative market event that may harm your investments. We do not assert that hedging will prevent a negative event from occurring. However, the impact of the event will be reduced if you are properly hedged when it occurs. A hedge, in simple terms, is an investment made to reduce the risk of adverse price movements in an asset. A hedge is a security investment that has a high correlation with the asset being hedged. It is an effective tool for mitigating downside risk in uncertain times. Derivatives are the most commonly used method of hedging in the investment world.

For example, you`re having long position in HDFC bank but you have dread in your mind that the stock might underperform or fall, therefore in order to protect yourself from downside risk, you`ve options like, first, you can buy put option or sell call option, and also you can sell futures of that particular stock, just to protect from the downside risk. This process is called hedging.

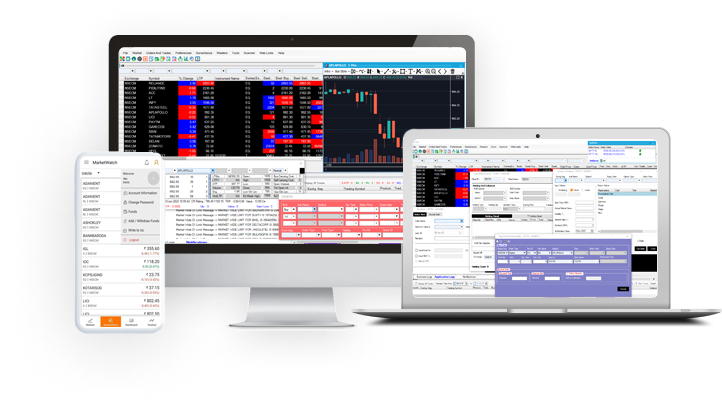

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily