All you need to know

as a beginner about

stock markets, investments,

trading & more..

Algo trading, also known as algorithmic trading is the process of using computer programmes to automate the process of trading (buying and selling) financial instruments (stocks, currencies, crypto currencies, and derivatives). Algorithms are simply a set of rules that a computer programme follows in order until it reaches a desired endpoint.

These computer programmes are programmed to trade in accordance with the rules that have been established for them. Algorithmic trading algorithms are simply a set of criteria that must be met in order to execute a buy or sell order.

Inputs could be based on a strategy to capitalize on various market behaviors, such as a specific price change that triggers an algorithm to execute specific trades, or other factors like volume, time, or technical indicators.

Enhanced discipline

Diversified trading

Increases order entry speed

Achieve consistency

Reduced emotional error

Simultaneous as well as multiple trading strategies.

Where speed is considered as one of the benefits of algorithmic trading, it is bundled with the risk of losing a great deal of money.

Mechanical / Technical failure

Internal or external threat actors can gain access to input data, algorithm designs, or its output and manipulate them to introduce deliberately flowed outcomes.

Algorithms when reacting to change in market conditions may widen the bid-ask spread, or may stop trading creating excessive volatility and hampering liquidity.

Due to high integration in the global markets, slowdown in one market moves over to other markets and asset classes creating a chain reaction. (As happened in subprime crises)

a faulty algorithm may pose risks of error trades and market manipulation causing millions of losses in a very short period of time.

the trader cannot monitor the algorithms when they are executed, leading to differences in expectations and results.

With brokers offerings multiple algorithms, Buy side lacks the tools to understand which algorithms would suit their portfolio. This also downgrades the quality of algorithms assessment.Many algorithms use similar basic functions to execute upon current market conditions which might lead to unfavorable outcomes.

Where few traders have the means to acquire sophisticated technology that executes orders, the others are still trading manually. This causes fragmentation in the market leading to liquidity in the short run.

Being based on computer systems, any technical default or error may cause system outage leading to backlashes in the market.

The traders lose confidence in the markets due to uncontrollable algorithmic results and repeated market issues.

The algorithms can only be accurate once the optimal selection is done.

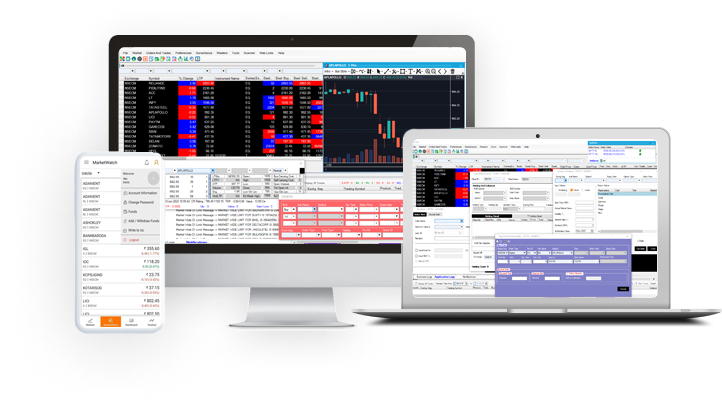

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily